Delve into the world of Long Home Improvement Financing Options Explained, where we unravel the mysteries behind financing your dream home projects. From traditional loans to government-backed options, this guide has it all.

Get ready to explore the ins and outs of long-term financing for home improvements and discover the best options tailored to your needs.

Introduction to Long Home Improvement Financing Options

Long-term home improvement financing refers to the various options available to homeowners to fund renovation or remodeling projects over an extended period. These financing solutions typically involve borrowing a large sum of money that is repaid over several years, allowing homeowners to make improvements to their property without having to pay the entire amount upfront.

Exploring different financing options for home projects is crucial as it enables homeowners to find the most suitable solution that fits their budget and needs. By considering various long-term financing options, individuals can choose a plan that offers favorable terms, low interest rates, and flexible repayment schedules.

The Benefits of Choosing Long-Term Financing for Home Improvements

- Low Monthly Payments: Long-term financing allows homeowners to spread the cost of home improvements over an extended period, resulting in lower monthly payments that are easier to manage.

- Flexible Repayment Terms: With long-term financing options, homeowners can select repayment terms that align with their financial capabilities, providing greater flexibility in managing expenses.

- Access to Larger Loan Amounts: Long-term financing typically offers higher loan amounts compared to short-term solutions, enabling homeowners to undertake more extensive renovation projects.

- Potential Tax Benefits: In some cases, the interest paid on long-term home improvement loans may be tax-deductible, providing additional financial advantages to homeowners.

Types of Long Home Improvement Financing Options

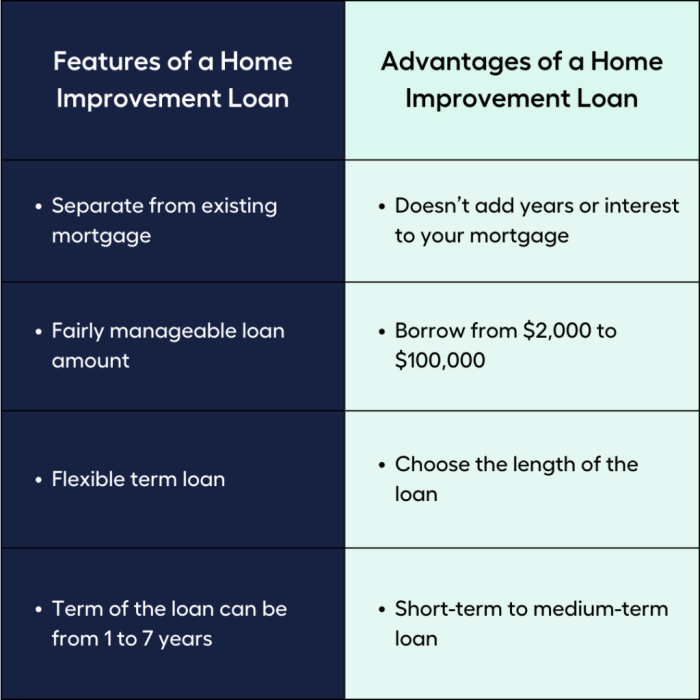

When it comes to financing long-term home improvement projects, there are various options available to homeowners. Some of the most common types of financing options include traditional loans, government-backed loans, and newer financing programs.

Traditional Options

- Home Equity Loans: These loans allow homeowners to borrow against the equity in their home, providing a lump sum of money to use for home improvement projects.

- Personal Loans: Another option is to take out a personal loan from a bank or online lender, which can be used for home renovations.

Government-Backed Options

- FHA Title 1 Loans: These loans are backed by the Federal Housing Administration and are specifically designed for home improvement projects.

- Energy-Efficient Mortgages: These loans incentivize energy-efficient upgrades by offering lower interest rates or higher loan amounts for eco-friendly improvements.

Newer Options

- PACE Financing: Property Assessed Clean Energy (PACE) financing allows homeowners to finance energy-efficient upgrades through a special assessment on their property tax bill.

- Contractor Financing Programs: Some contractors offer financing options to homeowners, allowing them to pay for renovations over time directly to the contractor.

Comparing Interest Rates and Terms

When considering long-term financing options for home improvement projects, it is crucial to compare the interest rates and terms offered by different lenders. These factors can significantly impact the overall cost of the project and the feasibility of repayment.

Interest Rates

Interest rates vary among different financing options, such as personal loans, home equity loans, or HELOCs. It is essential to compare these rates to determine the total amount of interest you will pay over the life of the loan. Lower interest rates can save you money in the long run.

Repayment Terms

The repayment terms associated with long-term financing options can vary in length, typically ranging from 5 to 30 years. Longer repayment terms may result in lower monthly payments but higher overall interest costs. Shorter terms may have higher monthly payments but lower total interest expenses.

Impact on Overall Cost

The combination of interest rates and terms can have a significant impact on the overall cost of your home improvement project. Lower interest rates and shorter repayment terms may result in higher monthly payments but lower total costs. On the other hand, higher interest rates and longer repayment terms can lead to lower monthly payments but higher total expenses.

Eligibility Criteria and Approval Process

When considering long-term home improvement financing options, it is important to understand the typical eligibility criteria and the approval process involved. These factors can greatly impact your ability to secure the necessary funds for your home renovation project.

Typical Eligibility Criteria

- Good credit score: Lenders often require a good credit score to qualify for long-term home improvement financing. A higher credit score demonstrates your ability to manage debt responsibly.

- Stable income: Lenders will also look at your income to ensure you have the means to repay the loan. A steady source of income is crucial for approval.

- Low debt-to-income ratio: Lenders typically prefer borrowers with a low debt-to-income ratio, as it shows that you are not overextended financially.

- Home equity: Some financing options may require you to have equity in your home, such as a home equity loan or line of credit.

Approval Process

- Application: The first step in the approval process is to fill out an application with the lender. You will need to provide personal and financial information for the lender to assess your eligibility.

- Review: The lender will review your application, credit history, income, and other relevant factors to determine if you meet their criteria for approval.

- Approval or denial: Based on their review, the lender will either approve or deny your application. If approved, you will receive the terms of the loan for your consideration.

- Acceptance: If you agree to the terms of the loan, you will need to sign the necessary paperwork to finalize the agreement.

Tips to Increase Chances of Approval

- Improve your credit score: Work on improving your credit score before applying for a home improvement loan. Paying down debt and making payments on time can help boost your credit score.

- Increase your income: If possible, try to increase your income to show lenders that you have the means to repay the loan.

- Reduce your debt: Lowering your debt-to-income ratio can make you a more attractive borrower to lenders. Consider paying down existing debt before applying for a loan.

- Shop around: Compare offers from multiple lenders to find the best terms and rates for your home improvement financing needs.

Pros and Cons of Long-Term Home Improvement Financing

When considering long-term financing options for home improvement projects, it is important to weigh the advantages and disadvantages to make an informed decision.

Advantages of Long-Term Financing

- Lower Monthly Payments: Long-term financing typically spreads out the cost over a longer period, resulting in lower monthly payments that may be more manageable for homeowners.

- Access to Higher Loan Amounts: Long-term financing options may allow homeowners to borrow larger sums of money, enabling them to undertake more extensive home improvement projects.

- Flexibility in Repayment: Long-term financing can offer flexibility in repayment terms, giving homeowners the ability to choose a repayment schedule that fits their budget.

- Potential Tax Benefits: In some cases, the interest on long-term home improvement loans may be tax-deductible, providing potential tax benefits for homeowners.

Drawbacks of Long-Term Financing

- Higher Total Interest Paid: While lower monthly payments can be beneficial, long-term financing often results in paying more interest over the life of the loan compared to shorter-term options.

- Extended Debt Obligation: Opting for long-term financing means committing to repay the loan over an extended period, which may result in a prolonged debt obligation for homeowners.

- Risk of Negative Equity: In some cases, extensive home improvement projects funded through long-term financing can lead to negative equity if the market value of the home does not increase sufficiently to cover the loan amount.

- Potential for Higher Interest Rates: Long-term financing options may come with higher interest rates compared to shorter-term loans, increasing the overall cost of borrowing.

When to Consider Long-Term Financing

- For Large-Scale Projects: Long-term financing is suitable for major home improvement projects that require a significant amount of funding.

- When Monthly Budget is Limited: If homeowners have limited monthly cash flow but need to finance a home improvement project, long-term financing with lower monthly payments may be a viable option.

- Long-Term Investment: If the home improvement project is expected to increase the value of the property significantly, opting for long-term financing could be a strategic investment.

Final Wrap-Up

As we wrap up our journey through Long Home Improvement Financing Options Explained, remember that the key to a successful home project lies in choosing the right financing strategy. Whether you opt for a traditional loan or an innovative program, make sure to weigh the pros and cons carefully to secure the home of your dreams.

Question & Answer Hub

What is the typical eligibility criteria for long-term home improvement financing?

Eligibility criteria usually include a good credit score, stable income, and sufficient equity in your home. Lenders may also consider the value of the project and your ability to repay the loan.

How can I increase my chances of approval for a home improvement loan?

To boost your approval odds, work on improving your credit score, reducing existing debt, and providing accurate and complete documentation to the lender. It also helps to have a stable source of income and a clear plan for the home improvement project.

When might it be beneficial to choose long-term financing for home projects?

Long-term financing is suitable for large-scale projects that require substantial funding, such as major renovations or additions. It can also be beneficial when you prefer predictable monthly payments over a longer repayment period.